Understanding Eligible Uses of The Fiscal Recovery Fund: How Counties Should Calculate Revenue Loss

Upcoming Events

Related News

BACKGROUND

On January 6, the U.S. Treasury released its Final Rule for the Coronavirus State and Local Fiscal Recovery Fund authorized under the American Rescue Plan Act (ARPA), which provides $65.1 billion in flexible, direct funding to counties of all sizes.

Counties may use Fiscal Recovery Funds to replace lost revenue and use these funds for a broad range of government services, programs and projects outside of explicit eligible uses of recovery funds under the Final Rule.

This page contains important information your county should reference when calculating its revenue loss. Additionally, it also provides access to a new revenue loss calculator that was developed by our partners at the Government Finance Officers Association (GFOA), which NACo members can use when determining revenue loss.

HOW DOES A COUNTY CALCULATE REVENUE LOSS?

Calculate Your County's Eligible Revenue LossThe Government Finance Officers Association (GFOA), a valued partner of NACo, developed a revenue loss calculator, that uses the formula referenced above to help counties calculate revenue loss. |

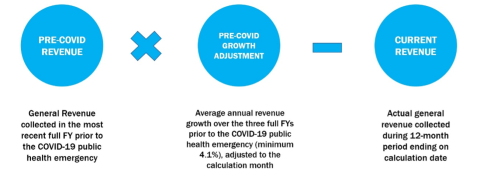

- A county must determine its revenue collected in the most recent full fiscal year prior to the pandemic (i.e. last full fiscal year prior to January 27, 2020), also known as the base year.

- After the base year figure is known, a county must determine its average annual growth rate (i.e. growth adjustment) over the last three fiscal years prior to the COVID-19 public health emergency.

- If a county’s average growth rate is less than 5.2 percent (based on the national average of state and local revenue growth 2015-18), then the county would use establish its growth rate as 5.2 percent.

- If their average growth rate is greater than 5.2 percent, then the municipality would use their municipality’s average growth rate over the past three fiscal years prior to the pandemic.

- Identify actual revenue, which equals revenues collected over the past 12 months.

The Government Finance Officers Association (GFOA), a valued partner of NACo, developed a revenue loss calculator, that uses the formula referenced above to help counties calculate revenue loss.

The figure below also provides an overview of how a county can calculate revenue loss, with a minimum of $0:

To view Treasury’s overview on the Final Rule's revenue loss guidance, click here and review pages 9-11.

IMPORTANT ITEMS TO REMEMBER WHEN CALCULATING REVENUE LOSS

- When calculating revenue loss, it is important for counties to keep in mind that it can be done for each calendar year. Counties will calculate their revenue loss at four points in time: December 31, 2020; December 31, 2021; December 31, 2022; and December 31, 2023

- Counties must calculate revenue loss on an entity-wise basis, rather than a source-by-source basis

- Counties cannot use pre-pandemic projections as a basis to estimate the reduction in revenue

- Under the Final Rule, counties may elect to forgo the revenue loss calculation formula and instead utilize the standard allowance of up to $10 million towards provisioning government services

WHAT IS EXCLUDED FROM THE REVENUE LOSS CALCULATION?

As outlined in Treasury’s Final Rule, there are several revenue streams that are excluded when calculating revenue loss, including:

- Correction transactions proceeds from issuance of debt or the sale of investments

- Agency or private trust transactions

- Revenue generated by utilities (water supply, electric power, gas supply and public mass transit systems)

- Federal transfers to local governments, including the CARES Act Coronavirus Relief Fund

- Liquor store revenue

- State transfers to local governments that are financed by federal grants

WHAT SORT OF REVENUE IS INCLUDED IN THE CALCULATION?

Treasury’s definition of “general revenue” includes:

- Taxes, fees and other revenue to support public services

- Fees generated by the underlying economy (I.e. enterprise function and component units)

- Civic centers

- Zoos

- Ports

- Parking

- Sports stadiums

- Transportation sector

- Enterprise funds

- Mental health facilities

- Liquor stores

- Counties that operate utilities that are part of their own government may choose to include revenue from these utilities in their calculations

WHAT CAN COUNTIES SPEND MONEY ON AFTER REVENUE LOSS IS CALCULATED?

Treasury’s Final Rule maintains that counties can use revenue recoupment dollars toward ANY government services including, but not limited to:

- Maintenance or pay-go pay-go funded building of infrastructure, including roads

- Modernization of cybersecurity, including hardware, software, and protection of critical infrastructure

- Healthcare services

- Environmental remediation

- School or educational services

- Provision of police, fire, and other public safety services

Revenue recoupment cannot be used for rainy day funds or debt services.

OTHER NACo RESOURCES

NACo has released an analysis of Treasury’s Final Rule that provides in-depth overview of the key provisions within the Final Rule, with a specific focus on how each of these items may impact county governments.

For NACo’s FAQs on the Fiscal Recovery Fund, click here.

To access NACo’s Fiscal Recovery Fund Resource Hub, click here.