Future of Digital Payments: Solutions for a Public-Private Partnership

Upcoming Events

Related News

|

Background

The COVID-19 pandemic and efforts to mitigate its spread have fast-tracked the transition from traditional to digital payment methods for businesses and local governments. Some counties deployed or invested in digital payments infrastructure to continue service delivery while adhering to health guidelines. In other instances, digital platforms were already in place, allowing some counties to adapt swiftly to the pandemic. In a recent member poll by NACo, 96 percent of respondents reported shifting operations or services to a digital platform, and 71 percent indicated that they were able to reopen operations or services more quickly due to already having a virtual option available.1 Though the pandemic offers counties an opportunity to expand digital payments, the transition will not be immediate. Counties must invest in digital infrastructure, train staff and communicate with residents the benefits of using digital payments.

In a recent member poll by NACo, 96 percent of respondents reported shifting operations or services to a digital platform, and 71 percent indicated that they were able to reopen operations or services more quickly due to already having a virtual option available.

This report presents the results of the pilot project conducted in Lancaster County, Neb. by NACo and Visa. Although the project took place before the pandemic, the results shed light on the possibilities for expanded digital payment options across counties, especially when in-person transactions (i.e., cash and check transactions) are not feasible. This report also provides recommendations and key takeaways for counties looking to expand digital payment usage and capacity to support constituents' shifting needs.

Throughout the project, the pilot county expanded ongoing outreach and marketing efforts that informed residents of the various options available to pay for taxes and services in a convenient and timely manner. In partnership with Visa, NACo assessed the effects of changes in transaction fee structures on digital payment usage. Finally, this report includes information on the county's purchasing program, which was not part of the pilot project, but provides useful insights that may help other counties shape the path toward digitizing procurement.

Note: In this report, “digital payment” refers to electronic payment methods, including credit and debit cards and electronic transfers, while “traditional payment” refers to payments made with cash or check.

Scope of Project in Lancaster County, Neb.

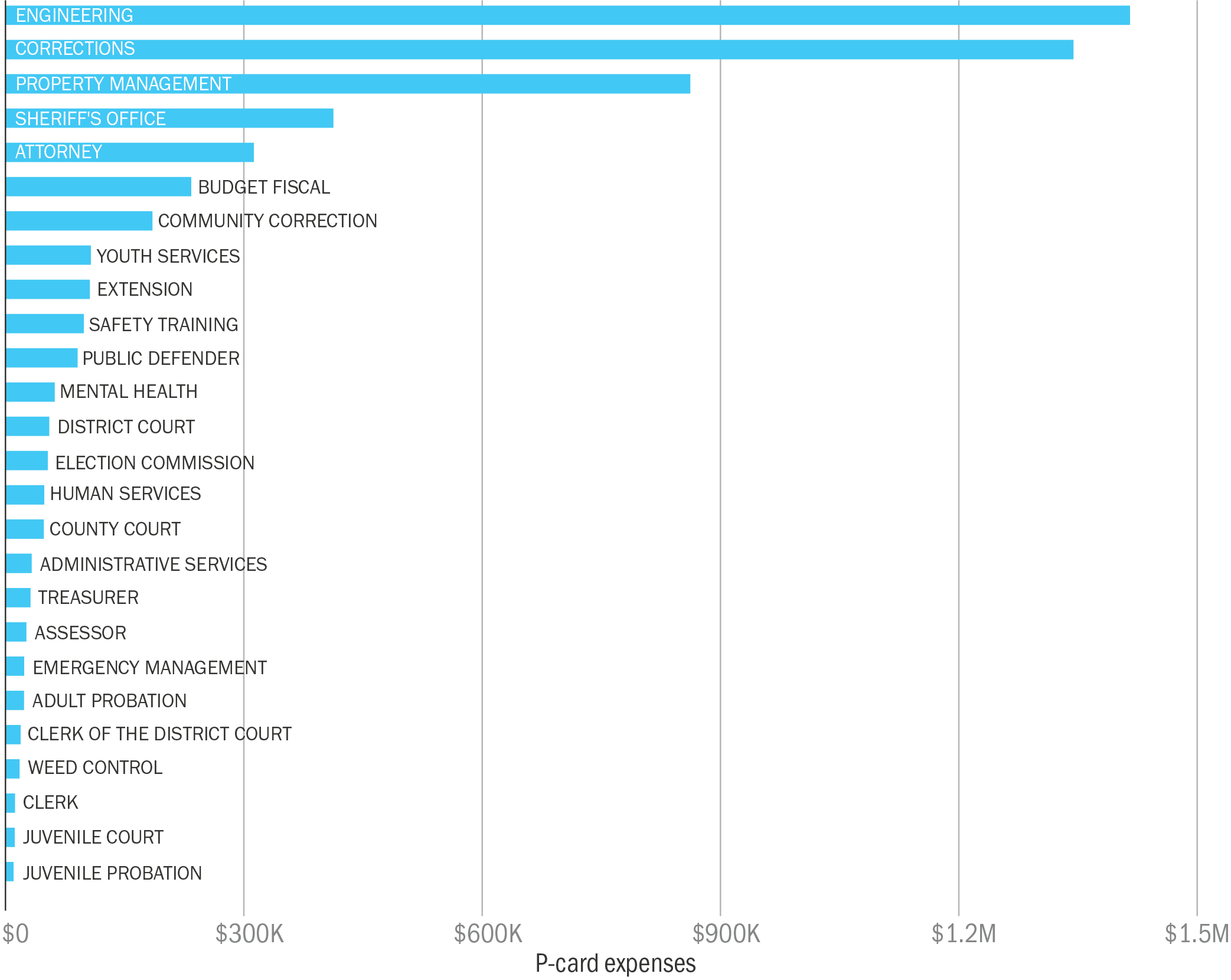

Source: NACo County Explorer Data

NACo and Visa developed selection criteria to identify candidate counties with the most potential to expand digital payment capabilities. Based on the agreed-upon standards and responses to the survey, Lancaster County, Neb. was selected out of nearly 700 counties to participate in the pilot project. Specifically, the project examined county departments' experience in accepting payments (revenue collection) and issuing disbursements and payments (purchasing/procurements). Furthermore, NACo examined how residents make payments to the county, and examined time and costs associated with each of these transaction channels. Nearly all county departments participated in some capacity in the pilot project in one or more of the transaction channels.

Note: In this report, these departments are referred to as “revenue-accepting departments.”

Individual departmental needs across these transaction channels were identified in a series of interviews with county staff. These departments provided insight into revenue collection practices across the county and were critical in identifying opportunities for expanding electronic payment options. The pilot project also highlighted barriers to adoption such as employee pushback on new technology, restrictive state mandates that require traditional payment methods and resident payment preferences for traditional options.

Acceptance (Revenue Collection)

Before the project began, Lancaster County implemented digital payment systems across all departments, though the systems were not robust. In the county, residents can make digital payments using credit card terminals, online portals and electronic deposits. More than half (59 percent) accepted payments by debit/credit card at an on-site credit card terminal among the revenue-accepting departments. At the start of the pilot project, only four departments (i.e., County Treasurer, Community Corrections, County Clerk and the Sheriff’s Office) offered an online portal for residents to make payments. Most recently, the Human Services/General Assistance department launched an online portal for accepting payments for diversion and restitution. Nearly all the departments that collect revenue accept payments via ACH deposit.

In FY17-18, the revenue-accepting departments collected more than $577 million in revenue. Traditional payment transactions (i.e., cash or check) comprised more than half (55 percent) of the funds collected by these departments. Among the revenue-accepting departments, the top five by revenue collection accounted for nearly 99 percent of the revenue collected—over $569 million—in FY17-18.

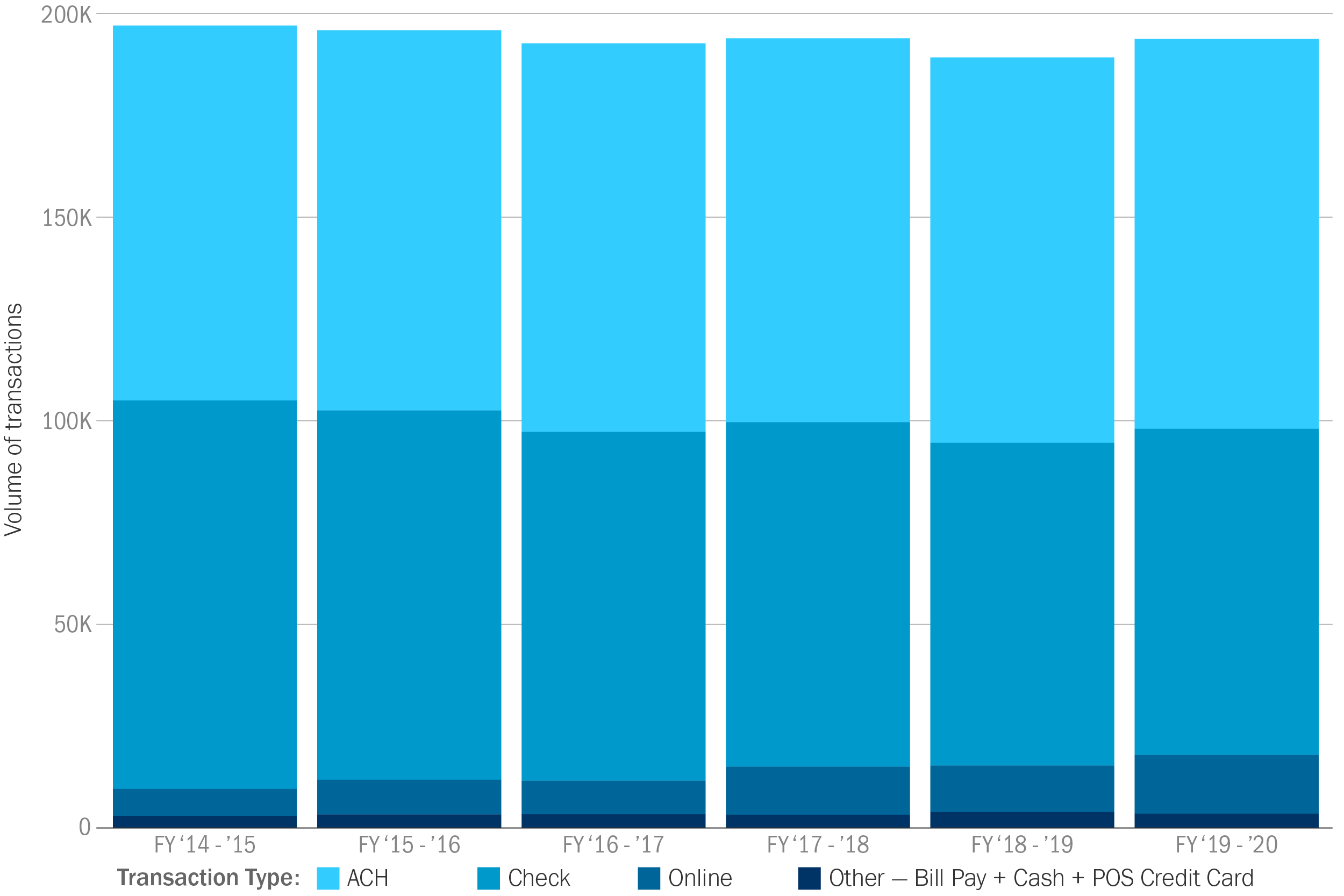

The County Treasurer's Office administers the collection and distribution of property and motor vehicle taxes, special assessments, driver's license fees and inheritance taxes. Most of the revenue collected by the County Treasurer’s Office is property tax revenue. Payments to the department can be made online, by mail, or at county point-of-sale (POS) locations. Despite the availability of digital payment options, in FY17-18, checks were the second-highest form of payment method used to pay for property taxes next to ACH deposit— accounting for 56 percent of the revenue collected. In that fiscal year, the department processed over 84,000 checks received in person and by mail with a dollar value of $265,644,295 for property tax payments. Figure 1: Checks and ACH deposits are the most used payment methods by residents for paying property taxesVolume of property tax transactions by payment method offered

Source: Lancaster County, Neb. Property Tax Revenue Collections (FY14-15 to FY19-20)Traditional transactions (i.e., cash and check) may be viewed by residents as a cost-free method of making payments to the county; however, there are costs associated that the county incurs in the form of time, staff and financial resources. Particularly for check payments, the costs vary depending on the mode of the transaction (whether in-person or by-mail) and can pile up. For instance, for a property tax payment made in person by check, the county estimates that it incurs a time and monetary cost of $1.23. However, for a property tax payment made via mail by check, the county estimates a cost of $3.12. These estimates translate into transaction costs of over $300,000 in staff time and other costs to process the over 84,000 paper checks received in person and by mail. |

Purchasing (Procurement or P-Cards)

Purchasing cards (also known as procurement cards or P‑Cards) are commercial cards that allow organizations to utilize existing digital payment infrastructure to make payments for various business expenses. P-Cards offer reduced administrative and transaction costs, quicker payments to vendors, improved transparency, efficient tracking of expenses and a streamlined purchasing and payment process. Another benefit of using purchasing cards is the P-Card issuing bank may provide a rebate based on transaction volume. Organizations develop policies, guidelines and procedures for P-Card usage, such as reviewing and approving transactions periodically.

Lancaster County, Neb., launched its purchasing card program in October 2018 across seven departments that had a one-card program (a department credit card) in place. The county issued 50 P-Cards in the program's early stages across those departments and recorded more than $100,000 in transactions. As of November 2020, 415 P-Cards are active across the county, with 48 percent (200 cards) used regularly.

As of July 2020, the P-Card program generated the county check process savings of $7.50 per transaction, translating into cost savings of approximately $162,000. The amount of check process savings and the number of P-Card transactions both increased by 60 percent between FY18-19 and FY19-20. Furthermore, since the P-Card program began, spending volume across departments earned the county nearly $138,000 in cash rebates.

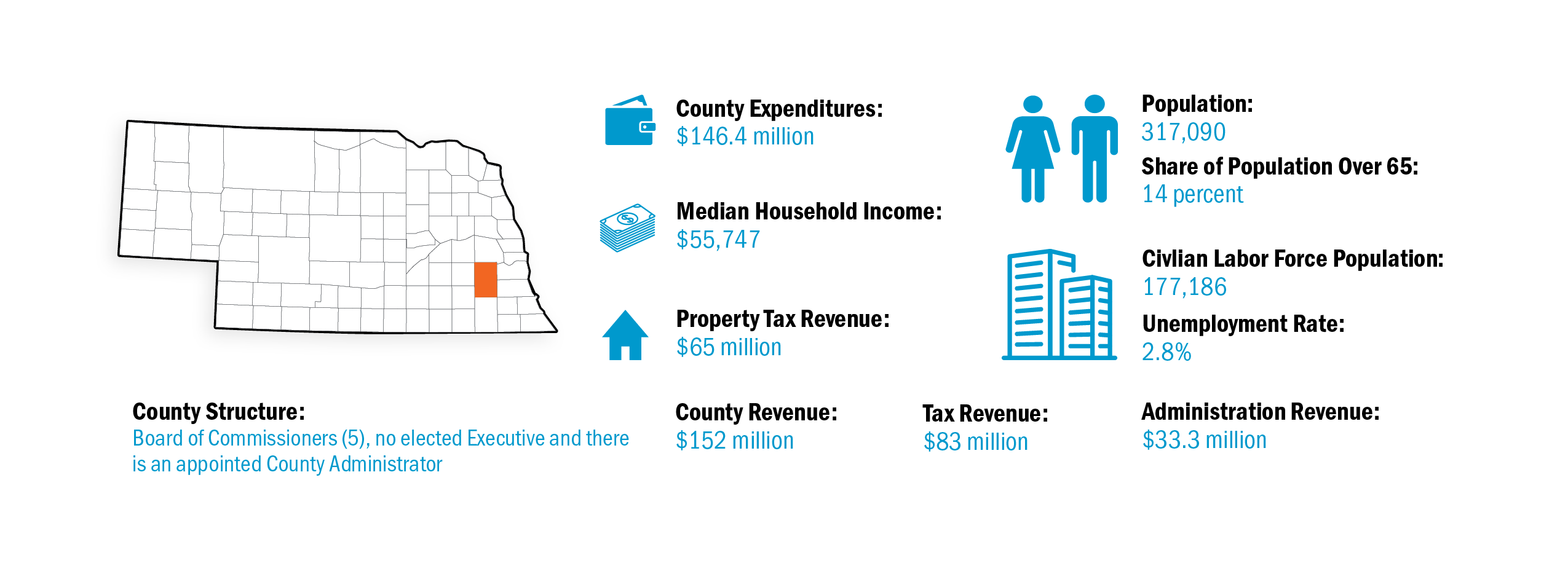

Figure 2: County departments spent $5.6 million across over 12,000 P-Card transactions in FY19-20

County-wide P-Card expenses for departments that spent $10,000 more in FY19-20

Source: NACo Analysis of Lancaster County, Neb. P-Card Transactions (FY19-20)

Before the P-Card program, purchases of supplies, equipment and other services were conducted through the county clerk’s office using payment vouchers. Currently, payment vouchers are the payment process if a P-Card is not used and involves the issuance of ACH remittance or checks from the county's accounting system. Thus, the P-Card program is an addition to the county’s procurement process.

Conversations with county staff and survey responses from cardholders and approving officials highlighted barriers to the P-Card program implementation, such as limitations with contracted vendors accepting P-Cards for payment, time-consuming data entry procedures, cumbersome state statute requirements and staff resistance to new purchasing processes.

Though the procurement process still involves checks, the county now has more transparency and accountability for purchases and a streamlined and efficient procure-to-pay process. P-Cards are used across 30 county departments, and county staff use the cards to routinely purchase supplies, materials and make payments for utilities and services from contract and non-contract vendors. The cards may be used for over-the-counter transactions and transactions by mail, telephone and online.

Disbursements (Payments to Residents and Between Departments)

Technology has contributed to the rapid change of payments, providing various options for county governments to disburse funds. According to a recent report by Visa Inc., traditional payment methods (i.e., checks and cash) comprise 66 percent of the total disbursement transactions.2 Generally, county governments and their agencies disburse payments via traditional means, such as paper checks, cash payouts and vouchers. County government disbursements include, for example, child support payments, real estate tax refunds, alimony and restitution payments.

In Lancaster County, some departments started to utilize electronic disbursement options such as ACH transfers, while others still mainly issued checks for disbursements. For example, the County Treasurer’s Office estimated that 12,000 refund checks are issued annually for real estate taxes, motor vehicle registrations, jury fees, witness fees, poll worker fees and restitution, among other reasons. On the other hand, the Clerk of the District Court utilized electronic payment methods and disbursement options to reduce the time and money spent on cutting checks substantially. Previously, the department processed, on average, 200 transactions of cash and check. After expanding electronic disbursement options, the department now processes about 20 transactions of cash and checks.

Digital disbursement methods include ACH (e-checks), wire transfers or prepaid debit cards to distribute funds to recipients person-to-person (P2P), business-to-consumer (B2C) and business-to-business (B2B), with the funds reaching the recipient’s accounts within 30 minutes. Similar revenue collection and procurement, counties stand to gain numerous benefits from digital disbursements such as:

One example of a digital disbursement solution available to counties is Visa Direct, a real-time payment platform, which utilizes the established payment flow of the Visa network to allow payouts to debit and reloadable pre-paid cards. Because the platform is currently in the development process, these features still only apply to certain Visa cards and acceptance still depends on the cardholder’s issuer. However, the program offers several possible benefits to its users, including increased speed of payment disbursements and improved customer experience. |

Solutions Implemented to Foster Increased Adoption of Digital Payments in the County

Before the pilot project launch, some Lancaster County departments engaged in marketing efforts to encourage residents to switch from traditional payment methods to electronic forms of payment. For instance, the office of the Clerk of the District Court sent out educational materials to residents to encourage them to sign up for electronic payments with the department. As a result, 90 percent of the revenue that was coming through checks is now collected through online payments. The County Treasurer’s Office also engaged in marketing and communication efforts that encouraged residents to pay their property taxes online. In addition to increased marketing, the county negotiated lower service fees and, as a result, reported a record 2,400 online property tax transactions more in December 2017 compared to December 2016.

A record 2,400 more online property tax transactions more were reported in December 2017 compared to December 2016.

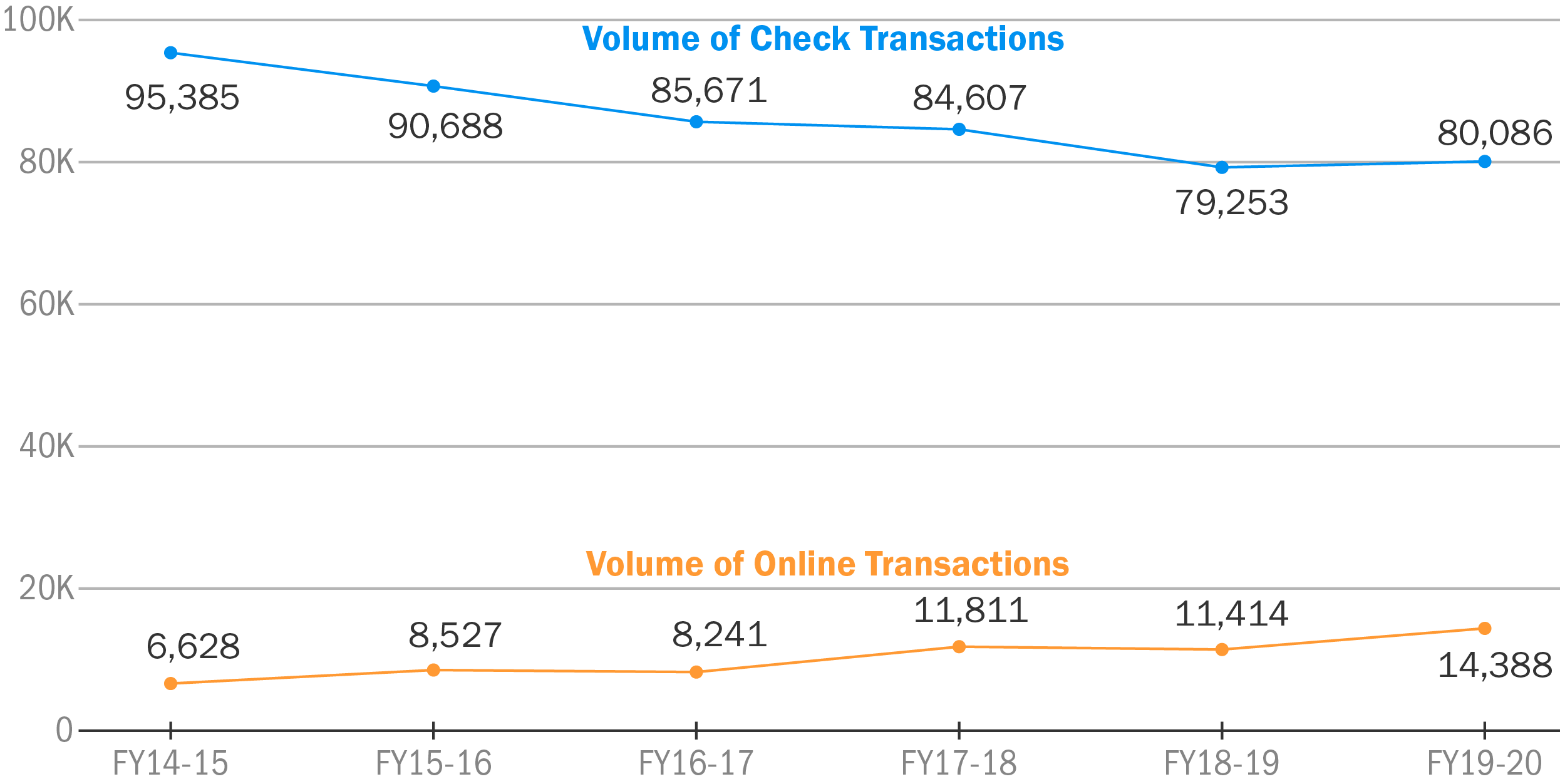

When comparing the trend in the volume of check and online transactions across the last six fiscal years (see figure 3 below), we find that between FY16-17 and FY17-18, the County Treasurer’s Office saw a 43 percent increase in the number of online property tax transactions. In that same period, the number for check property tax transactions dropped by one percent. These trends occurred following the marketing and communication efforts led by the County Treasurer’s Office. Based on further conversations with the county, the percentage increase in online property tax transactions between that period can also be attributed to a change in Federal Tax Code whereby, starting in 2018 taxpayers could no longer deduct property tax payments from their Federal Income Tax. As a result, many residents paid their 2018 property taxes earlier in December 2017 to take advantage of the tax incentive that was to expire at the end of 2017.

Figure 3: Between FY16-17 and FY17-18, the number of online property tax transactions increased by 43 percent

Volume of check and online property tax transactions

Source: NACo Analysis of Lancaster County, Neb. Property Tax Transactions (2014-2019)

As part of the pilot project, the county collaborated with Visa to further address marketing efforts, transaction fees and service charges. Visa worked with Lancaster County and local issuing banks on a county-wide marketing effort to promote the fee structure and general use of digital payments with the county. Outreach and educational materials were developed and placed at county point-of-sale (POS) locations at the various revenue accepting departments, as well as at banks.

Additionally, the pilot project provided a testing platform to assess the impact of transaction fee structures on digital payment usage. Effective March 1st, 2019, all transactions made on the County Treasurer's website using a Visa debit card were subject to a capped $5.00 fee. The fee structure change was in place through December 2019. As of July 2020, the capped fee for debit cards was extended to include other types of debit cards; Lancaster County announced that in addition to Visa debit cards, MasterCard and Discover debit cards now have a maximum fee of $5.00. These fees are only applicable to online property tax payments.

Conclusion

Digital payment methods have a crucial role now more than ever in supporting county operations amid this public health crisis. This report details Lancaster County's experience in expanding digital payment usage, and while it serves as an excellent case study, each county's experience will be unique regarding the approach taken to implement digital payment systems. The implementation of digital payment systems requires:

- an investment in communication and marketing efforts to inform constituents of the benefits of using digital payments;

- insights into how constituents prefer to make payments for various services;

- an understanding of how vendors prefer to accept payments for purchases;

- and an analysis of how a change in internal processes will impact staff.

Endnotes

1. NACo Analysis of Survey Data from County Leaders, 2020.

2. Aite Group, “North America Insights on Real-Time Payments,” Visa Inc. Available at: usa.visa.com (June 2018)

Report PDF

Download the report PDF here.

County News

Leading the charge toward digital payments

Related News

Rising costs, federal cuts challenge some counties

Some counties across the country are reducing staff to alleviate budget deficits, as a result of rising operational costs and cuts to funding and jobs at the federal level.

U.S. House Appropriators release minibus funding package

The funding package includes key county priorities, including funding for community and economic development, election administration and security, taxpayer services and intergovernmental partnerships.