Federal Reforms to Medicaid Financing: What Counties Should Know

Author

Blaire Bryant

Naomi Freel

Upcoming Events

Related News

Medicaid is a joint federal, state and local program that provides health coverage to low-income individuals, including children, pregnant women, elderly adults and people with disabilities. The program accounts for over half of all federal funding to states and is the largest source of federal funding in state budgets.

Jump to Section

Medicaid is a joint federal, state and local program that provides health coverage to low-income individuals, including children, pregnant women, elderly adults and people with disabilities. The program accounts for almost 30 percent of state expenditures and is the largest single source of federal funding in state budgets.

Counties play a crucial role in delivering Medicaid services by partnering with federal and state governments to manage local health systems and ensure access to care for vulnerable populations. Any reductions in Medicaid funding directly affect counties' ability to provide public health services, respond to crises and promote economic stability.

On July 4, President Trump signed the One Big Beautiful Bill Act (P.L. 119-21), also known as H.R. 1, into law. This sweeping reconciliation package included nearly $1.1 trillion in federal spending cuts over the next decade (FY 2024–2034), according to cost estimates by the Congressional Budget Office (CBO). A significant share of these savings—an estimated $911 billion of federal spending cuts—comes from changes to the Medicaid program. These Medicaid reforms are expected to increase the number of uninsured individuals by 10 million over the same period, as projected by the CBO. These changes carry significant implications for counties, which play a central role in financing and administering Medicaid, and in delivering healthcare services for residents.

This resource page outlines key provisions of the Medicaid reforms included in the reconciliation package, along with their implementation timelines. It is designed to help county leaders understand the enacted reforms, navigate new federal requirements and manage local budgets in the face of reduced federal support.

Overview of Medicaid provisions

While some Medicaid provisions of H.R. 1 offer relief from administrative burdens and funding cuts for county health facilities, others raise concerns given their potential for cost shifts and administrative burden.

Expand each issue below to understand the policy and its impact on counties.

H.R. 1 delays implementation of the federal nursing home staffing rule which would require long term care facilities to meet arduous minimum staffing levels. The law prohibits the U.S. Department of Health and Human Services from implementing or enforcing this rule until October 1, 2034, easing pressure on county-run facilities facing workforce shortages.

Implementation date: Delays implementation until October 1, 2034

The Affordable Care Act allowed states to expand Medicaid eligibility to adults with incomes up to 138 percent of the federal poverty line. To incentivize state expansion, the American Rescue Plan offered newly expanding states a temporary 5 percent increase in the federal Medicaid match rate (FMAP) for two years. H.R. 1 removed this incentive, meaning that any states that expand after January 1, 2026, will no longer qualify for the enhanced federal funding. For counties in non-expansion states, this means that if their state expands Medicaid after the deadline, a greater share of the expansion costs will fall more heavily on the state and local governments, increasing their share of expenses for resident care.

Implementation date: January 1, 2026

States fund the non-federal share of Medicaid through variety of sources; one common source is health care related taxes, of “provider taxes.” H.R. 1 prohibits all states from creating new provider taxes or increasing rates of existing provider taxes beyond what was in effect of the time of enactment—July 4, 2025. In addition, the law gradually reduces the safe harbor threshold in expansion states for all provider types except nursing and intermediate care facilities by 0.5 percent each year, starting on October 1, 2027, and ending in 2032 when the threshold reaches 3.5 percent. For counties that help contribute to the non-federal share of Medicaid in their states, capping other Medicaid payment streams, such as provider taxes, may increase the county share of the non-federal Medicaid payment. In all counties, this change may mean that more state dollars must go towards Medicaid payments, reducing the amount of funds available for local initiatives.

CBO estimate of coverage loss: Increases the number of people without health insurance by 400,000 in 2034

Implementation date: July 4, 2025 (prohibition on new and increased provider taxes); October 1, 2027 (reduction in safe harbor limit)

Prior to passage of H.R. 1, states could only impose Medicaid work or reporting requirements by obtaining a Section 1115 waiver. Following passage, H.R. 1 now makes work requirements mandatory for certain Medicaid populations nationwide, effective no later than December 31, 2026. States must condition eligibility for adults ages 19–64 in the expansion population on completing at least 80 hours per month of work, qualifying community activities or part-time schooling. Exemptions apply for certain groups including minors, caretakers of children 13 years or younger, recently incarcerated individuals, those with medical hardships, those in substance use disorder treatment or residents of disaster-affected areas. States must verify compliance at each eligibility redetermination and may conduct additional verifications more frequently. Individuals who fail to meet the requirement are also barred from receiving subsidized Marketplace coverage. These provisions cannot be waived under Section 1115 authority, though the Secretary of Health and Human Services may grant a non-renewable exemption through December 31, 2028, to states that demonstrate a good faith effort to comply.

The law also provides $200 million to states and $200 million to HHS in FY 2026 to support implementation and systems development. Counties that help administer Medicaid or operate safety-net hospitals could see an increase in uninsured residents if individuals lose coverage for failing to meet work requirements. This may raise uncompensated care costs and increase demand for county-funded health and human services. Counties that help administer Medicaid may also face increased administrative costs and burdens in verifying compliance with these new requirements.

CBO estimate of coverage loss: Federal Medicaid coverage would decrease by 4.8 million adults in 2034

Implementation Date: December 31, 2026 (or earlier with state option)

H.R. 1 imposes new out-of-pocket costs on Medicaid enrollees in the expansion population starting October 1, 2028. States must impose cost sharing up to $35 per service, with exemptions on primary care, mental health, substance use disorder services or services at federally qualified health centers (FQHCs) and similar clinics. Despite excluding health clinics, the provision is likely to increase uncompensated care costs for county safety net hospitals.

Implementation date: October 1, 2028

Unlike Medicare, states and counties are required to cover long-term care facilities under Medicaid. Most states opt to use 1915(c) waivers to provide long-term care in home and community settings through Home and Community-Based Services (HCBS). Previously, these waivers were limited to individuals requiring an institutional level of care. Under H.R. 1, states can now extend these waivers to people who do not need institutional care, provided they demonstrate that doing so will not increase average wait times for those who do require institutional-level services. For counties, this change could expand access to HCBS for residents, potentially reducing reliance on higher-cost institutional care. However, it may also increase demand for county-administered services and require careful resource planning to ensure timely access for those with the highest care needs.

Implementation date: July 1, 2028 (new waiver approval begins)

H.R. 1 adds several new administrative requirements that would increase the burden on counties, particularly in states where counties are responsible for Medicaid eligibility operations.

These include:

- Twice-yearly eligibility redeterminations beginning on December 31, 2026

- Quarterly review to ensure enrollees are not deceased beginning on January 1, 2027

- Quarterly review to ensure providers are not deceased beginning on January 1, 2028

- Verify enrollee addresses beginning on January 1, 2027

Individuals with disabilities may be exempted from this requirement.

CBO coverage loss estimate: Increases the number of people without health insurance by 700,000 in 2034

Implementation date: Please see above for implementation dates associated with each new verification and redetermination requirement.

Subject to approval by the Centers for Medicare and Medicaid Services (CMS), states are allowed to require managed care organizations (MCOs) to pay specific rates or use certain payment methods. Under H.R. 1, the U.S. Department of Health and Human Services is required to set lower limits for state-directed payments and reduce existing payments by 10 percent each year until they reach the new lower limit. For counties, these changes could result in lower Medicaid reimbursement rates for hospitals and other local providers, increasing uncompensated care costs and placing greater financial strain on county health systems.

Implementation date: July 4, 2025 (lower limit on new state directed payments); January 1, 2028 (reduction in existing state directed payments)

H.R. 1 cuts retroactive Medicaid coverage from three to two months for the non-expansion population and from three to one month for the expansion population. These changes may contribute to increased delays in care and increased uncompensated care costs, resulting in financial strain on county-owned and operated health systems.

Implementation date: January 1, 2027

How do Medicaid reforms impact counties?

Counties are integral to Medicaid administration, funding and service delivery. In 24 states, counties contribute to the non-federal share of Medicaid costs, directly impacting local budgets. Counties also operate over 900 hospitals, 700 nursing homes, 750 behavioral health authorities and over 1900 local health departments, providing essential healthcare services.

Changes to Medicaid under H.R. 1 reduces federal Medicaid spending by an estimated $911 billion over the next decade, reflecting the administration’s goal of reducing federal outlays, but the need for care will not disappear. As a result, state and local governments may have to absorb a larger share of these costs, creating a significant cost shift from the federal to the local level. The law’s Medicaid provisions are also projected to increase the number of uninsured people by over 10 million people in 2034, which would increase uncompensated care costs for counties by shifting the financial burden from the federal government to local hospitals and health care systems.

Figure 1

Impact of Certain H.R. 1 Provisions on the Rate of Uninsured As Outlined by CBO in a Letter to House Democratic Leadership on June 4

CBO Estimated Coverage Loss by 2034

Source: Congressional Budget Office. “Letter to the Hon. Ron Wyden, Hon. Frank Pallone Jr. and Hon. Richard E. Neal on Estimated Effects on the Number of Uninsured People in 2034.” Congressional Budget Office, June 4, 2025. Available at cbo.gov.

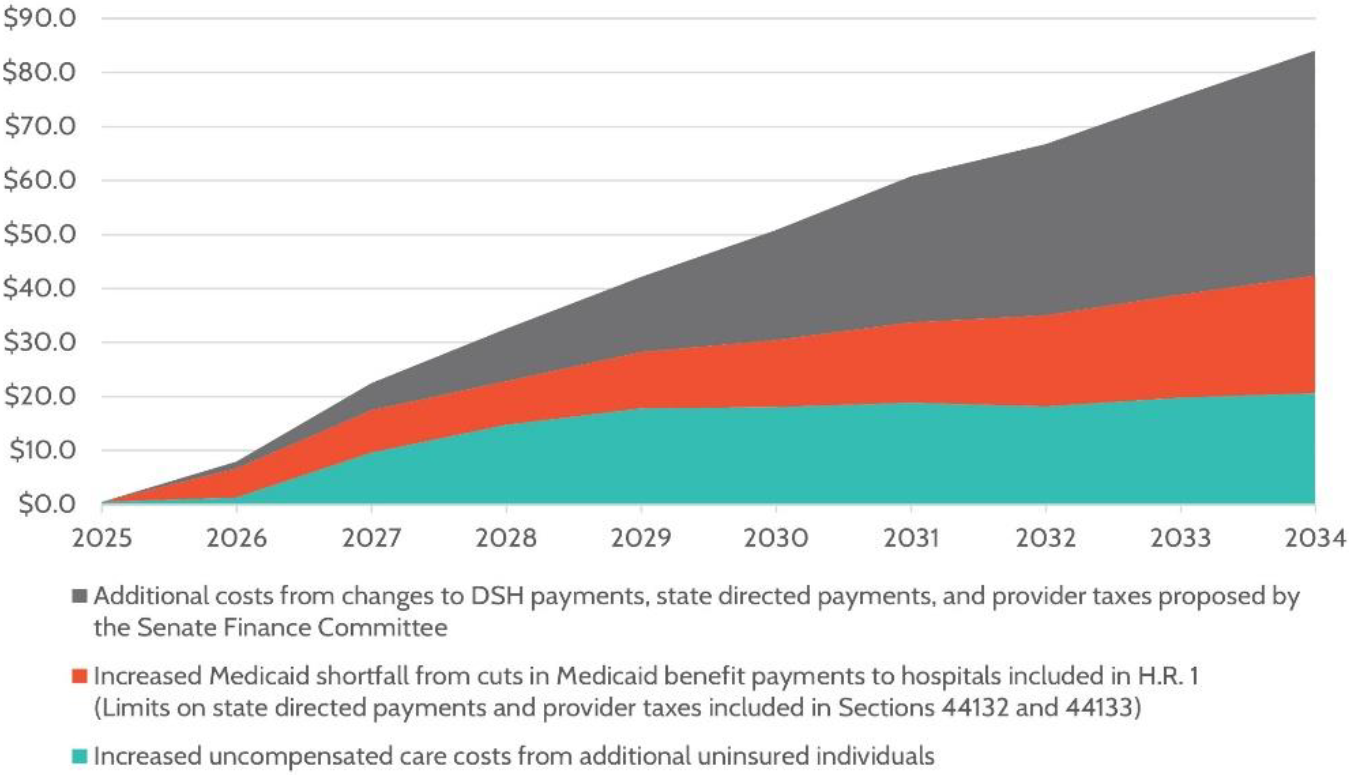

Figure 2

Projected Increase in Uncompensated Care Costs for Hospitals Under H.R. 1. 2025-2034 (Billions)

Source: America’s Essential Hospitals, June 2025

Figure 3

Federal Medicaid Cuts Under H.R. 1 as a percent of 10-year baseline federal spending (2025-2034)

Note: $911 billion in federal Medicaid spending cuts over the 10-year period is allocated across states, including $79B in estimated Medicaid spending interactions.

Source: KFF, Allocating CBO’s Estimates of Federal Medicaid Spending Reductions Across the States: Enacted Reconciliation Package, July 2025

Implementation Timeline

Implementation dates for key healthcare provisions:

Date | Description | Type |

|---|---|---|

July 4, 2025 | Prohibition on creating or increasing provider taxes begins; new limit on state-directed payments established. | |

October 1, 2025 | Rural Health Transformation Program funds become available. | |

December 31, 2025 | Rural Health Transformation Program state application deadline. | |

January 1, 2026 | Enhanced FMAP for new expansion states sunsets. | |

June 1, 2026 | HHS Secretary is required to promulgate guidance on work requirements. | |

October 1, 2026 | Emergency Medicaid services FMAP is reduced to standard Medicaid FMAP for services provided to those “not lawfully admitted for permanent residence or otherwise permanently residing in the United States under color of law.” | |

October 1, 2026 | Medicaid & CHIP eligibility is limited to those with US citizenship, green card holders, certain Cubans and Haitians, and COFA residents, with an exception at state option for children under age 21 and pregnant women. | |

December 31, 2026 | States begin twice-yearly eligibility redeterminations. | |

January 1, 2027 | Community engagement (“work”) requirements begin (with option for earlier state adoption). | |

January 1, 2027 | Quarterly review to verify enrollee addresses. | |

January 1, 2027 | Quarterly review to ensure enrollees are not deceased. | |

January 1, 2027 | Presumptive eligibility shortened. | |

October 1, 2027 | Safe harbor threshold for provider taxes reduced by 0.5% annually. | |

January 1, 2028 | States must reduce existing state-directed payments until they reach new lower limits. | |

January 1, 2028 | Quarterly review to ensure providers are not deceased begins. | |

July 1, 2028 | New Home and Community-Based Services (HCBS) requirements implemented. | |

October 1, 2028 | New Medicaid cost-sharing requirements for expansion enrollees take effect. | |

October 1, 2034 | Nursing Home Staffing Rule implementation begins. |

The Rural Health Transformation Program

H.R. 1 created a $50 billion Rural Health Transformation Program (RHTP) to address concerns about its impact on rural hospitals, which have been closing at alarming rates. Funded for five years, the program supports state-led initiatives to expand access, improve outcomes, adopt new technologies, recruit clinicians and stabilize hospital finances.

On December 29, the Centers for Medicare & Medicaid Services (CMS) announced that all 50 states would be awarded RHTP funding for Fiscal Year (FY) 2026 following their submission of applications in November. The RHTP invests $50 billion over five years (FY 2026–2030) to strengthen rural health systems by improving access, workforce capacity, technology and innovative models of care. Half of these funds were distributed equally amongst all approved states for the fiscal year; the other half were allocated by CMS based on factors such as content and quality of the application and rural factors.

NACo continues to track state implementation and the impacts on county governments and residents. See all funding award levels and publicly available applications by state below.

- Alabama | Alabama RHTP Project Narrative | FY2026 Award Amount: $203,404,327

- Alaska | Alaska RHTP Initiatives | FY2026 Award Amount: $272,174,856

- Arizona | Arizona RHTP Project Narrative | FY2026 Award Amount: $166,988,956

- Arkansas | Arkansas Rural Health Transformation Program Application | FY2026 Award Amount: $208,779,396

- California | Rural Health Transformation Program Overview - California | FY2026 Award Amount: $233,639,308

- Colorado | Colorado Rural Health Transformation Program | FY2026 Award Amount: $200,105,604

- Connecticut | Connecticut Rural Health Transformation Program Grant Application | FY2026 Award Amount: $154,249,106

- Delaware | Rural Health Transformation Program Application Documents | FY2026 Award Amount: $157,394,964

- Florida | Florida Submits Application to Federal Rural Health Transformation Program | FY2026 Award Amount: $209,938,195

- Georgia | Georgia’s Application to the RHT Program | FY2026 Award Amount: $218,862,170

- Hawai'i | Hawaiʻi’s Rural Health Transformation Plan | FY2026 Award Amount: $188,892,440

- Idaho | About the Rural Health Transformation Program Grant | FY2026 Award Amount: $185,974,368

- Illinois | Rural Health Transformation - Kentucky | FY2026 Award Amount: $193,418,216

- Indiana | Indiana Rural Health Transformation Program Grant Application Working Group | FY2026 Award Amount: $206,927,897

- Iowa | Iowa HHS - Rural Health Transformation (RHT) | FY2026 Award Amount: $209,040,064

- Kansas | Kansas Project Narrative | FY2026 Award Amount: $221,898,008

- Kentucky | Not yet publicly available | FY2026 Award Amount: $212,905,591

- Louisiana | Full application is not yet publicly available, click here for an overview | FY2026 Award Amount: $208,374,448

- Maine | Rural Health Transformation Program - Maine DHHS | FY2026 Award Amount: $190,008,051

- Maryland | Rural Health Transformation Program (RHTP) - Maryland | FY2026 Award Amount: $168,180,838

- Massachusetts | Rural Health Transformation Program (RHTP) - Massachusetts | FY2026 Award Amount: $162,005,238

- Michigan | Rural Health Transformation Program - Michigan | FY2026 Award Amount: $173,128,201

- Minnesota | Rural Health Transformation Program - Minnesota | FY2026 Award Amount: $193,090,618

- Mississippi | Full application is not yet publicly available, click here for the summary | FY2026 Award Amount: $205,907,220

- Missouri | Full application is not yet publicly available, click here for the Guide for Stakeholders | FY2026 Award Amount: $216,276,818

- Montana | Rural Health Transformation Program Application - Montana | FY2026 Award Amount: $233,509,359

- Nebraska | Not yet publicly available | FY2026 Award Amount: $218,529,075

- Nevada | Rural Health Transformation Program - Nevada | FY2026 Award Amount: $179,931,608

- New Hampshire | Rural Health Transformation Program - New Hampshire| FY2026 Award Amount: $204,016,550

- New Jersey | Not yet publicly available | FY2026 Award Amount: $147,250,806

- New Mexico | State of New Mexico Rural Health Transformation Program Application | FY2026 Award Amount: $211,484,741

- New York | Full application is not yet publicly available, click here for the summary | FY2026 Award Amount: $212,058,208

- North Carolina | Rural Health Transformation Program - North Carolina | FY2026 Award Amount: $213,008,356

- North Dakota | Rural Health Transformation - North Dakota's Application | FY2026 Award Amount: $198,936,970

- Ohio | Rural Health Transformation Program - Ohio | FY2026 Award Amount: $202,030,262

- Oklahoma | Full application is not yet publicly available, click here for the proposed initiatives | FY2026 Award Amount: $223,476,949

- Oregon | Informing the State’s Rural Health Transformation Program - Oregon | FY2026 Award Amount: $197,271,578

- Pennsylvania | Rural Health Transformation Plan Summary - Pennsylvania | FY2026 Award Amount: $193,294,054

- Rhode Island | Rural Health Transformation Grant Application - Rhode Island | FY2026 Award Amount: $156,169,931

- South Carolina | Full application is not yet publicly available, click here for the summary | FY2026 Award Amount: $200,030,252

- South Dakota | Rural Health Transformation Project - South Dakota | FY2026 Award Amount: $189,477,607

- Tennessee | Rural Health Access for Tennessee's Future | FY2026 Award Amount: $206,888,882

- Texas | RHTP Application - Rural Texas Strong: Supporting Health and Wellness | FY2026 Award Amount: $281,319,361

- Utah | Full application is not yet publicly available, click here for the summary | FY2026 Award Amount: $195,743,566

- Vermont | H.R.1/Rural Health Transformation Fund - Vermont | FY2026 Award Amount: $195,053,740

- Virginia | Full application is not yet publicly available, click here for the summary | FY2026 Award Amount: $189,544,888

- Washington | Rural Health Transformation Program - Washington State | FY2026 Award Amount: $181,257,515

- West Virginia | Full application is not yet publicly available, click here for the summary | FY2026 Award Amount: $199,476,099

- Wisconsin | Rural Health Transformation Program - Wisconsin | FY2026 Award Amount: $203,670,005

- Wyoming | Wyoming’s Rural Health Transformation Program | FY2026 Award Amount: $205,004,743

The RHTP offers counties and their state counterparts an important opportunity to strengthen local health care systems, particularly in areas where hospitals face financial strain or workforce shortages. As states maintain primary discretion over what was included in the applications, counties will need to be proactive in shaping implementation of the state’s transformation plans once funding is announced. Early involvement will help ensure the county perspective is incorporated as states determine the specific strategies for implementing their proposed plans.

Legislation tracker

Since the enactment of H.R. 1, lawmakers from both parties have introduced proposals to amend or reverse key provisions of the law. These measures focus on a variety of topics, including rolling back Medicaid cuts or otherwise addressing the potential impacts on healthcare access, particularly in rural areas. Below is a legislation tracked of bills that, if enacted, would significantly alter H.R. 1 healthcare provisions.

S. 2279 | Protect Medicaid and Rural Hospitals Act

This legislation would repeal the H.R. 1 provider tax moratorium and related limits on state-directed payments, restoring key Medicaid funding mechanisms, while doubling the Rural Health Transformation Fund to $100 billion and extending its duration from five to ten years. These changes could help maintain higher Medicaid reimbursement rates for county hospitals and providers and expand access to funding for vulnerable hospitals and health systems in rural counties.

Sponsor: Sen. Josh Hawley (R-Mo.)

S. 2556 | Protecting Health Care and Lowering Costs Act

This legislation would roll back all healthcare cuts in H.R. 1, including those affecting Medicaid, and permanently extend the Affordable Care Act (ACA) premium tax credits. For counties, reversing these cuts would preserve federal funding for Medicaid services and reduce the risk of coverage losses among residents, lessening pressure on county budgets tied to uncompensated care and safety-net health services.

Sponsors: Sens. Chuck Schumer (D-N.Y.), Ron Wyden (D-Ore.), Jeanne Shaheen (D-N.H.), Jeff Merkley (D-Ore.) and Ben Ray Luján (D-N.M.)

Co-sponsored by the entire Senate Democratic Caucus

Featured Resources

The Big Shift: An Analysis of the Local Cost of Federal Cuts

This report outlines how the federal cost shift and spending cuts pose a significant challenge to counties nationwide. It aims to clarify the scope of the potential impact, highlight key areas of concern and provide county leaders with the information needed to prepare for and respond to these intergovernmental changes.

Medicaid and Counties: Understanding the Program and Why It Matters to Counties

Medicaid operates and is jointly financed as a partnership between federal, state and local governments.

Protect the Federal-State-Local Partnership for Medicaid

Urge your members of Congress to support the federal-state-local partnership structure for financing and delivering Medicaid services and to oppose any measure that would further shift federal and state Medicaid costs to counties–including cuts, caps, block grants and new limits on counties’ ability to raise the non-federal match or receive supplemental payments.

Contact

Blaire Bryant