Updated NACo Analysis: Overview of U.S. Treasury's Final Rule for ARPA Fiscal Recovery Fund

Upcoming Events

Related News

Key Highlights of the Guidance

- Final Rule is effective April 1, 2022, but counties can take advantage of new provisions prior to the effective date

- Allows counties to use up to $10 million of ARPA Recovery Funds as “lost revenue” for the provision of general government services without needing to use the Treasury revenue loss formula

- Improves revenue loss calculation formula to include utility revenue and liquor store sales, at option of counties

- Clarifies eligible use of funds for capital expenditures and written justification for certain projects

- Presumes certain populations were “impacted” and “disproportionately impacted” by the pandemic and therefore are eligible to receive a broad range of services and support – designed to minimize administrative burden

- Streamlines options for premium pay, by broadening the share of eligible workers who can receive premium pay

- Authorizes re-hiring of local government staff, either at or above pre-pandemic levels

- Allows Recovery Funds to be used for modernization of cybersecurity, including hardware and software

- Broadens eligible use of funds for water and sewer projects to include culvert repair, dam and reservoir rehabilitation

- Broadens eligible broadband infrastructure investments to ensure better connectivity to broader populations

Jump to Section |

Watch: NACo Overview of Final Rule

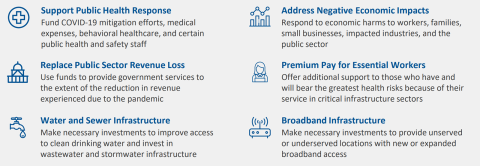

Illustration Only of Allowable Uses of Recovery Funds, Per U.S. Treasury Guidance

Decoding the Language of the Guidance

Throughout the Final Rule, U.S. Treasury uses various key words that are important to understand in determining the eligible use of funds.

- “Should” and “must” = mandatory reporting, use and compliance

- “May” and “encourage” = Allows county discretion, even as a federal preference

- Proportional & Reasonable are key terms in determining the level of investment for eligible activities

Replacing Lost Revenue

Counties can use Recovery Funds to provide government services, up to the amount of revenue loss experienced using one of two Treasury approaches.

- NEW $10 million revenue loss allowance

- Improvements to the revenue loss formula

Key New Features in Final Rule

1. New $10 Million Revenue Loss Allowance

- Counties may allocate up to $10 million of their total Recovery Fund allocation to spend on government services

- Counties may still calculate actual revenue loss through Treasury formula – both must pick 1 of the 2 approaches

- Simplifies reporting requirements for counties using the standard $10M standard allowance

- 2,137 counties (70%) now eligible to invest entirety of allocated Recovery Funds in general government services

2. Improvements to the Revenue Loss Formula

- Revenue loss growth rate changed from 4.1% to 5.2% as the new standard default allowance for the formula

- General revenue now includes utility revenue and liquor store revenue, at the discretion of the county

- Counties may choose to calculate revenue loss on a fiscal year or calendar year basis – must pick & stay with one option

- Counties must adjust actual revenue totals for the effect of tax cuts/increases adopted after January 6, 2022

Counties may use “lost revenue” for general government services up to the revenue loss amount, whether that be the standard allowance amount ($10 million) or the amount calculated using Treasury’s formula:

- Government services generally include any service traditionally provided by a government, unless Treasury has stated otherwise

- Common examples include, but are not limited to:

- Construction of schools and hospital

- Road building and maintenance, and other infrastructure

- Health services

- General government administration, staff and administrative facilities

- Environmental remediation

- Police, first responders and other public safety services (including purchase of fire trucks and police vehicles)

Recovery funds used to replace “revenue loss” are more flexible and may be used for a broad range of government services, programs and projects outside of typical eligible uses of recovery funds under the final rule. However, revenue recoupment cannot be used for rainy day funds, debt services, and extraordinary pension contributions.

HOWEVER, the following activities are NOT an eligible use of a county’s “revenue loss” allowance:

- Extraordinary contribution to a pension fund

- Debt service payment, including Tax Anticipation Notes (TANs)

- Rainy day or reserve account

- Settlement agreement, judgment, consent decree or judicially confirmed debt (with limited exceptions)

- (NEW) Activity that conflicts with the purpose of the American Rescue Plan Act statute (e.g. uses of funds that conflict with COVID-19 mitigation practices in line with CDC guidance and recommendations)

- Violations of Award Terms and Conditions or conflict of interest requirements under the Uniform Guidance

Key Takeaways

- Counties have two options to calculate revenue loss:

1. Up to $10 million of ARPA allocation standard allowance, OR

2. Calculate revenue loss with Treasury formula, with a new 5.2% default growth rate - Final Rule increases the “average annual growth rate” from 4.1% to 5.2% when calculating revenue loss, or the county can calculate its own average annual growth rate

- If your county previously declared “$0” for revenue loss in the Interim Report, the county may change and update this number in the first Project and Expenditure Report

- If your county is declaring revenue loss, you must still abide by the reporting requirements within the Project and Expenditure Report’s “revenue loss” category

Public Health Impacts

Counties can use funds for other aspects of public health responses.

Covid-19 Mitigation

The Final Rule provides a list of enumerated eligible uses for COVID-19 mitigation including, but not limited to:

- Vaccination/testing programs

- Monitoring, contact tracing and public health surveillance

- Public health data systems

- COVID-19 prevention and treatment

- Support for isolation and quarantine

- Transportation to reach vaccination or testing sits, or other prevention and mitigation services for vulnerable populations

- Support for prevention, mitigation or other services in congregate living facilities, public facilities, schools, small businesses, nonprofits and impacted industries

- Emergency operation centers and emergency response equipment (I.e. emergency response radio systems)

Medical Expenses

Recovery Funds may be used for expenses to households, medical providers, or other incurred medical costs due to the pandemic, including:

- Unreimbursed expenses for medical care for COVID-19 testing or treatment (I.e. uncompensated care costs)

- Paid family and medical leave for public employees

- Emergency medical response expenses

- Treatment of long-term symptoms or effects of COVID-19

Counties may use Recovery Funds for uncompensated care costs for medical providers or out-of-pocket costs for individuals

Behavioral Health Care

The Final Rule allows a very broad range of activities, including for the general public:

- Behavioral health facilities and equipment

- Prevention, outpatient treatment, inpatient treatment, crisis care, diversion programs

- Enhanced behavioral health services in schools

- Services for pregnant women or infants born with neonatal abstinence syndrome

- Support for equitable access to reduce disparities in access to reduce disparities in access to high-quality treatment

- Peer support groups, costs for residence in supportive housing or recovery housing, the 988 National Suicide Prevention Lifeline

- Expansion of access to evidence-based services for opioid use disorder prevention, treatment, harm reduction and recovery

Negative Economic Impacts

The Final Rule outlines eligible uses of Recovery Funds to respond to the impacts of the pandemic on households and communities.

Key New Features in Final Rule

1. Aid to Impacted Industries

- Clarifies how to designate an impacted industry

- Clarifies eligible uses to impacted industries

2. Public Sector Capacity

- Allows re-hiring of county staff to pre-pandemic levels, OR

- Adjusted level up to 7.5% above pre-pandemic baseline

- Support for staff retention, avoiding layoffs and funds for furloughed workers

3. Capital Expenditures

- Eligible projects must respond to pandemic and be proportional to impact

- Required written justification for certain projects

Aid to Impacted Households & Industries

Impacted Households

Treasury presumes the following households and communities are impacted by the pandemic:

- Low-or-moderate income households or communities

- Households that experienced unemployment

- Households that experienced increased food or housing insecurity

- Households that qualify for CHIP, childcare subsidies, CCDF or Medicaid

- Households that qualify for National Housing Trust Fund – for affordable housing programs

- Any student that lost access to in-person education – services to address lost instructional time in K-12

The Final Rule outlines the following eligible uses of Recovery Funds to respond to the impacts of the pandemic on households and communities (non-exhaustive list):

- Food assistance and food banks

- Emergency housing assistance

- Health insurance coverage expansion

- Benefits for surviving family members who have died from COVID-19

- Burials, home repair and home weatherization

- Cash assistance

- Assistance in accessing and applying for public benefits or services

- Child care and early learning services

- Assistance to address the impact of early learning loss for K-12 students

Disproportionately Impacted Households

Treasury presumes the following households and communities are disproportionately impacted by the pandemic:

- Low-income households and communities

- Households residing in Qualified Census Tracts (QCTs)

- Households that qualify for certain federal benefits (i.e. TANF, SNAP, SSI, WIC, Section 8 vouchers, LIHEAP)

- Households receiving services provided by Tribal governments

The Final Rule outlines the following eligible uses of Recovery Funds to respond to the disproportionate impacts of the pandemic on households and communities (non-exhaustive list):

- Pay for community health workers to help households access health and social services

- Remediation of lead paint or other lead hazards

- Primary care clinics, hospitals, integration of health services into other settings, and other investments in medical equipment and facilities designed to address health disparities

- Housing vouchers and assistance relocating to neighborhoods with higher economic opportunity

- Investments in neighborhoods to promote improved outcomes

- Improvements to vacant/abandoned properties

- Services to address educational disparities

- School and other educational equipment and facilities

The Final Rule also clarifies what a “low-income” and “lor-or-moderate income” household is:

| Impacted Household Overview | Disproportionately Impacted Household Overview |

|---|---|

|

|

AID TO IMPACTED HOUSEHOLDS & INDUSTRIES

IMPACTED HOUSEHOLD OVERVIEW | DISPROPORTIONATELY IMPACTED HOUSEHOLD OVERVIEW |

|---|---|

|

|

ASSISTANCE TO SMALL BUSINESSES

Treasury defines small businesses by having no more than 500 employees, in general, and is independently owned and operated and is not dominant in its field of operation.

IMPACTED SMALL BUSINESSES | DISPROPORTIONATELY IMPACTED SMALL BUSINESSES |

|---|---|

|

|

ELIGIBLE USES TO SUPPORT IMPACTED SMALL BUSINESSES | ELIGIBLE USES TO SUPPORT DISPROPORTIONATELY IMPACTED SMALL BUSINESSES |

|---|---|

|

|

ASSISTANCE TO NONPROFITS

Treasury defines a nonprofit as 501(c)(3) and 501(c)(19) tax-exempt organizations.

IMPACTED NONPROFITS | DISPROPORTIONATELY IMPACTED NONPROFITS |

|---|---|

|

|

ELIGIBLE USES INCLUDE

- Loans or grants to mitigate financial hardship

- Technical or in-kind assistance or other services that mitigate negative economic impacts of the pandemic

AID TO IMPACTED INDUSTRIES

The Final Rule states that an industry can be designated as “impacted”:

- If the industry is in the travel, tourism or hospitality sectors, the industry is impacted

- If the industry is outside of travel, tourism or hospitality sectors, the industry is impacted if:

- The industry experienced at least 8 percent employment loss from pre-pandemic levels, or

- The industry is experiencing comparable or worse economic impacts as the tourism, travel and hospitality industries as of the date the Final Rule is published (12/6/2022)

Recipients (i.e. counties) have flexibility to define industries

Aid can only be provided to businesses and attractions that were operating prior to the pandemic and affected by required closures

RESTORE PUBLIC SECTOR CAPACITY

Counties may use Recovery Funds to restore and bolster public sector capacity, which supports government’s ability to deliver critical COVID-19 services.

1. Payroll and covered benefits for public safety, public health, health care, human services and similar employees of a recipient government

2. Rehiring public sector staff to pre-pandemic levels or above pre-pandemic levels (7.5 percent growth allowance)

3. Support and retaining public sector workers by:

- Providing additional funding for employees who experienced pay reductions or were furloughed

- Maintain current compensation levels to prevent layoffs

- Provide worker retention incentives, including reasonable increases in compensation (must be additive to an employee’s regular compensation and are less than 25 percent of the rate of base pay for an individual and no more than 10 percent for a group)

- Cover administrative costs associated with administering with hiring, support and retention programs

4. Effective service delivery

PUBLIC SAFETY, PUBLIC HEALTH AND HUMAN SERVICES STAFF

PUBLIC SAFETY STAFF | PUBLIC HEALTH STAFF | HUMAN SERVICES STAFF |

|---|---|---|

|

|

|

GOVERNMENT EMPLOYMENT AND REHIRING PUBLIC SECTOR STAFF

Counties have two options to restore pre-pandemic employment, depending on the recipient’s needs:

1. Hire back county FTEs for pre-pandemic positions that existed on January 27, 2020

OR

2. Hire above the pre-pandemic levels of up to 7.5 percent above pre-pandemic baseline. If a county wants to hire above pre-pandemic baseline, it must complete the following steps:

- Identify the county’s FTE level on January 27, 2020

- Multiply the pre-pandemic baseline by 1.075 (adjusted pre-pandemic baseline)

- Identify county’s budgeted FTE level on March 3, 2021 (actual number of FTEs)

- Subtract the actual number of FTEs from the adjusted re-pandemic baseline to determine number of FTEs that can be covered. Counties do NOT have to hire for the same role that existed pre-pandemic

EFFECTIVE SERVICE DELIVERY

Recovery Funds may be used to improve the efficacy of public health and economic programs.

Supporting program evaluation, data and outreach through:

- Program evaluation and evidence resources

- Data analysis resources to gather, assess, share and use data

- Technology infrastructure to improve access to and user experience of government IT systems

- Community outreach and engagement activities

Administrative needs:

- Backlogs caused by shutdowns (NACo Note Only: court backlogs, records backlogs, service backlogs)

- Technology infrastructure to adapt government operations to the pandemic (i.e. video-conferencing software, data and case management systems)

CAPITAL EXPENDITURES

Counties can use Recovery Funds for capital expenditures that respond to the public health and negative economic impacts of the pandemic.

Projects must be related to public health and/or negative economic impacts and be proportional to the pandemic impact identified

No pre-approval is required or provided for capital expenditures

To ensure the expenditure is eligible, counties are required to write a written justification for capital expenditures equal to or greater than $1 million, which includes the following:

- Description of harm or need to be addresses (i.e. number of individuals)

- Explanation of why the capital expenditure is appropriate (i.e. why existing resources are inadequate)

- Comparison of proposed capital expenditure project against at least two alternative capital expenditures and why the proposed capital expenditure is superior

COUNTIES ARE REQUIRED TO WRITE A WRITTEN JUSTIFICATION FOR CAPITAL EXPENDITURES EQUAL TO OR GREATER THAN $1 MILLION

COST OF CAPITAL EXPENDITURE PROJECT | USE IS ENUMERATED BY TREASURY AS ELIGIBLE | USE IS BEYOND THOSE ENUMERATED BY TREASURY AS ELIGIBLE |

|---|---|---|

Less than $1 million | No written justification required | No written justification required |

Greater than or equal to $1 million, but less than $10 million | Written justification required but county does not need to submit as part of reporting | Written justification required and county must submit as part of regular reporting |

$10 million or more | Written justification required and county must submit as part of regular reporting | Written justification required and county must submit as part of regular reporting |

EXAMPLES ELIGIBLE CAPITAL EXPENDITURE PROJECTS | EXAMPLES INELIGIBLE CAPITAL EXPENDTIURE PROJECTS |

|---|---|

|

|

|

PREMIUM PAYCounties may use Recovery Funds to provide premium pay ($13/per hour) to eligible workers performing essential work, either in public sector roles or through grants to third-party employers. |

1. ADDITIONAL STREAMLING OF PREMIUM PAY

2. CLARIFICATION ON TYPES OF ELIGIBLE PREMIUM PAY

|

The Final Rue outlines three steps for determining premium pay eligibility:

1. Any work performed by an employee of the state, local or tribal government, among others

2. Verify that the eligible worker performs essential work including risk of COVID exposure

- Work involving regular in-person interactions or regular physical handling of items also handled by others

- Worker would NOT be engaged in essential work if telework performed from a residence

3. Confirm that premium pay responds to workers performing essential work during the public health emergency

- Determine average annual wage for county employees

- Any employee normally eligible for overtime as non-exempt from the FLSA overtime provisions

- If worker does not meet any of the above, county must submit written justification with presumptive allowance

UNDER THE FINAL RULE, PREMIUM PAY MAY STILL BE RETROACTIVE AND ONLY BE PROVIDED TO ELIGIBLE WORKERS THAT ARE PERFORMING ESSENTIAL WORK (IN PERSON/REGULAR PHYSICAL HANDLING OF ITEMS)

|

WATER AND SEWER INFRASTRUCTURECounties can use to make a broad range of water and sewer infrastructure investments. |

NEW ELGIBLE WATER AND SEWER PROJECTS

|

|

BROADBAND INFRASTRUCTUREThe Final Rule broadens eligible broadband infrastructure investments to ensure better connectivity for residents. |

BROADENS BROADBAND INFRASTRUCTURE FLEXIBILITY

THE FINAL RULE ALSO INCLUDES THE FOLLOWING CLARIFICATION ON BROADBAND PROJECTS:

|

|

|