ARPA State and Local Fiscal Recovery Fund Obligation Updates & Guidance

The American Rescue Plan Act (ARPA) of 2021 allocated $65.1 billion in direct funding to every county, parish and borough across the country through the State and Local Fiscal Recovery Fund (SLFRF). The U.S. Department of the Treasury (Treasury) issued two final rules in 2022 and 2023 to guide the eligible uses of SLFRF funds and the timeline for their obligation and expenditure. On March 29, 2024, Treasury released a new obligation Interim Final Rule (IFR) along with corresponding FAQs to address counties' questions and provide additional clarification on some key topics including obligations around personnel expenses, reclassifying funds and subrecipients. NACo tirelessly advocated for the additional flexibilities granted by the new Obligation FAQs.

This overview provides information about the major updates to eligible uses Treasury’s definition of obligation and its impact on counties and our ARPA investments.

Key Highlights

- Counties may use SLFRF funds for personnel costs for any eligible position through Dec. 31, 2026, that was filed with Treasury prior to Dec. 31, 2024

- Counties may reorganize positions and continue to cover personnel costs, so long as the positions were established before Dec. 31, 2024

- Funds MAY NOT be used to cover any new positions after Dec. 31, 2024

- Counties shall estimate the amount of SLFRF funds they will use for personnel costs

- Subrecipients are not subject to obligate provisions by Dec. 31, 2024, yet are still required to expend funds by Dec. 31, 2026

Time for Use for SLFRF Funds

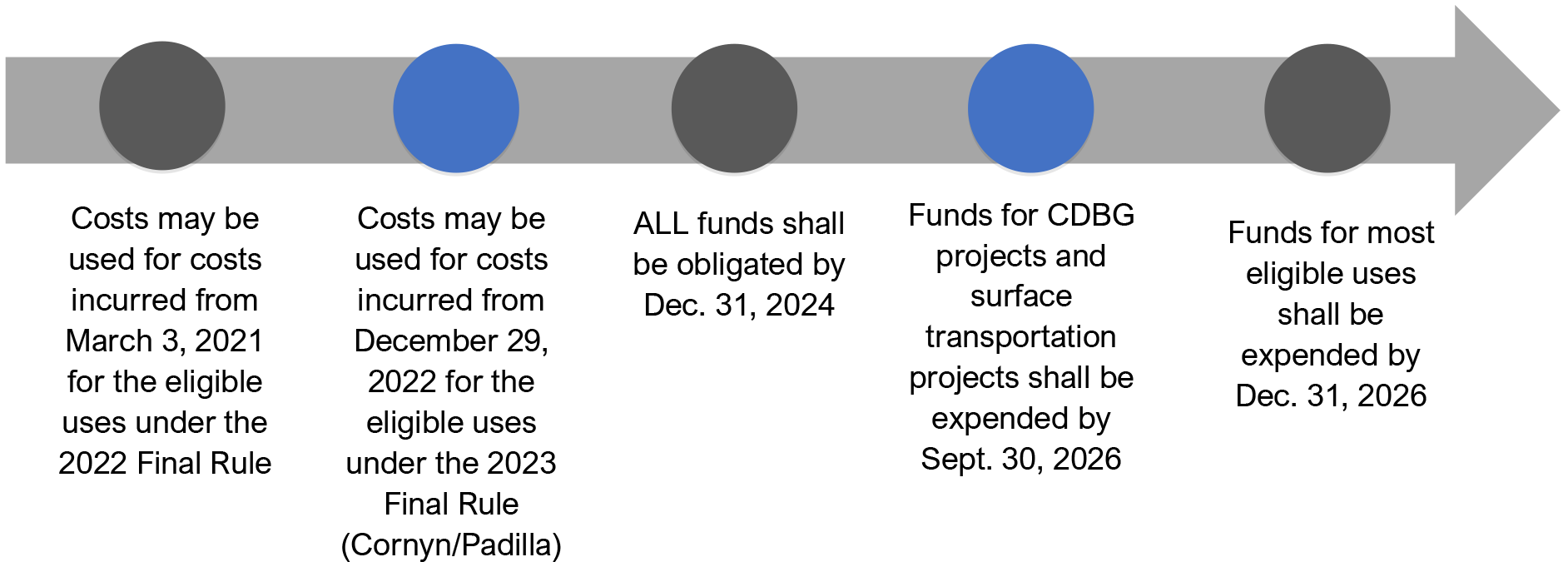

There are a handful of major timelines for the ARPA SLFRF, which outline what costs can be covered with funds, and obligation and expenditure deadlines. All counties are required to comply with these dates and timelines per Treasury’s guidance. The below infographic highlights major dates for counties.

Definition of Obligation

- An order placed for property and services and entry into contracts, subawards and similar transactions that require payment.

- A requirement under federal law or regulation or provision of the SLFRF award terms and conditions to which a county becomes subject as a result of receiving or expending SLFRF funds.

- Please note the definition of obligation is different than expenditure. The definition of expenditure is payment with either cash or credit to purchase goods or services.

Revenue Loss

Under the Obligation FAQs, the same definition of “obligation” applies to funds used under the revenue loss category.

- If your county claimed the $10 million revenue loss standard allowance, the new Obligation guidance does not impact your county.

- If your county opted for calculating your revenue loss with Treasury’s revenue loss calculator. Those revenue loss dollars are not impacted by the Obligation guidance.

Personnel Costs

Under Treasury’s new Obligation FAQs, counties may now cover personnel costs for eligible positions under the 2022 Final Rule. Previously, counties were only able to cover personnel costs for a limited scope of employees.

Eligible Uses

- Counties may use SLFRF funds for personnel costs for any eligible position through Dec. 31, 2026, that was filed with Treasury prior to Dec. 31, 2024

- Personnel costs include:

- Salary and wages

- Covered benefits

- Payroll taxes

- Counties may reorganize positions and continue to cover personnel costs, so long as the positions were established and reported to Treasury BEFORE the Dec. 31, 2024 obligation deadline

Reporting Requirements

If a county decides to use SLFRF funds towards covering personnel costs, the county shall provide specific information about anticipated costs to Treasury ahead of obligating funds. Counties shall complete the following steps:

- Estimate the amount of SLFRF funds the county anticipates using for personnel costs

- Identify a reasonable justification for the estimate – Treasury will provide additional guidance for how this should be reported in future Project and Expenditure Reports

- Report the estimate to Treasury by:

- January 31, 2025 – Quarterly reporters (Counties with populations above 250,000 residents or received more than $10 million in SLFRF funding)

- April 30, 2025 – Annual reporters (Counties with populations below 250,000 residents or received less than $10 million in SLFRF funding)

- Report out on Dec. 31, 2026, how much the county actually spent on personnel costs

Example 1: If there is turnover in personnel, a county may continue to pay different personnel in the same job position

Example 2: Counties may reorganize positions within eligible SLFRF uses after Dec. 31, 2024, but shall not add new positions

Example 3: If a county has reported 10 job training specialist positions by Dec. 31, 2024, it may use the funds to cover payroll for one of those training specialists who is promoted

Reclassifying Funds

Under the new Obligation FAQs, counties may now reclassify funds to other eligible SLFRF expenses. This represents a new and effective flexibility to ensure counties may cover unforeseen costs or shift funds to other eligible projects.

- After the Dec. 31, 2024, obligation deadline, a county may have excess SLFRF funds that were obligated by the obligation deadline, yet not expended on an eligible activity/project

- If your county does have excess funds that were already obligated by Dec. 31, 2024, yet have not been expended before the Dec. 31, 2026 expenditure deadline, the county may reclassify SLFRF funds from the original activity (that was reported on your Project and Expenditure Report) to another eligible SLFRF project – Your county is only allowed to reclassify funds if you have incurred an obligation for the project by Dec. 31, 2024

Example 1: A county allocated funds to a surface transportation project that was over budgeted. The excess funds from this project may pay for cost adjustments in other contracts, such as a housing project.

Example 2: An Auditor in the county’s 2024 Single Audit identified that a project is not eligible. The county may withdraw SLFRF funds from that project and reclassify the funds to a locally-funded project, so long as it is an eligible project under SLFRF. The county may use the excess funds to finance this project, so long as they incurred an obligation (by entering into a contract) by Dec. 31, 2024.

Program Income

Counties may add program income earned from programs established with SLFRF funds to their Treasury allocation.

Key items to note for program income under Treasury’s guidance include:

- Program income may be earned between 31, 2024 to Dec. 31, 2026, as long as it is used or costs incurred by Dec. 31, 2024

- Counties can use program income in the following ways:

- Cover costs for any eligible SLFRF use if incurred by Dec. 31, 2024 (i.e. local workforce training program that the county had been funding with local funds)

- Pay for permissible upward cost adjustments in contracts or subawards (or replacement contracts/subawards)

- Cover expenses that are necessary to meet certain legal and administrative requirements

- Cover personnel costs obligated by Dec. 31, 2024

PLEASE NOTE: Program income is NOT the same as interest earned from SLFRF funds. Under Treasury’s guidance, interest earned from SLFRF funds is not subject to program restrictions and can be used for any general government service.

Key Upcoming Deadlines

DEADLINE | ACTION |

Dec. 31, 2024 | ARPA SLFRF obligation deadline for ALL COUNTIES |

Jan. 31, 2025 | Quarterly reporters – Submit estimated SLFRF fund personnel costs to Treasury |

April 30, 2025 | Annual reporters – Submit estimated SLFRF fund personnel costs to Treasury |

Sept. 30, 2026 | Expenditure deadline for CDBG and surface transportation projects as authorized under the Cornyn/Padilla amendment |

Dec. 31, 2026 | Expenditure deadline for most SLFRF funds |

Advocacy

Treasury Department releases new obligation guidance for the ARPA State and Local Fiscal Recovery Fund

On March 29, the U.S. Department of Treasury released new FAQs related to their Obligation Interim Final Rule for the ARPA Recovery Fund.

Related News

U.S. House Appropriators release minibus funding package

The funding package includes key county priorities, including funding for community and economic development, election administration and security, taxpayer services and intergovernmental partnerships.

County Countdown – Dec. 15, 2025

Every other week, NACo's County Countdown reviews top federal policy advocacy items with an eye towards counties and the intergovernmental partnership.