Counties Struggle with State Revenue Limitations, Mandates

Upcoming Events

Related News

A new study to be released by NACo this week examines the financial pressures facing counties as they grapple with state limits on their ability to raise revenue, and the impact of state and federal mandates.

The report includes a breakdown of county revenue sources along with state limitations on property taxation and sales taxes.

Counties directly affect the economic vitality and quality of life in their communities. This role encompasses a range of services, from maintaining 45 percent of America’s roads to supporting nearly 1,000 hospitals to keeping communities safe through law enforcement.

These services require massive resources including more than $106 billion annually in building infrastructure, and maintaining and operating public works; more than $53 billion annually in construction of public facilities; and nearly $70 billion annually for community health and hospitals.

But increasing restrictions from the states on counties’ capacity to raise revenue is making service delivery more difficult. State caps such as restricting the types of taxes counties may impose, limits on tax rates and total revenues collected, and an obstacle-strewn approval process financially handcuff counties.

Concurrent with these constraints, state and federal governments require counties to provide a growing scope of services. These mandates are often unfunded either entirely or partially. Revenue sharing by states and other state and federal funding for county services alleviate some of these mandate-related costs. But in many instances, the supplementary sources have declined and become more unpredictable. Overall, seven years following the end of the Great Recession, fiscal tensions continue to reign across counties, with inflation-adjusted general revenue fully recovered in only 46 percent of counties.

A few key takeaways on the revenue limitations include:

- Property taxes and sales taxes are the main general revenue sources for most counties. While counties in 45 states collect property taxes, most often they keep less than a quarter of the total collected (23.7 percent). Most property taxes (49.9 percent) go to schools.

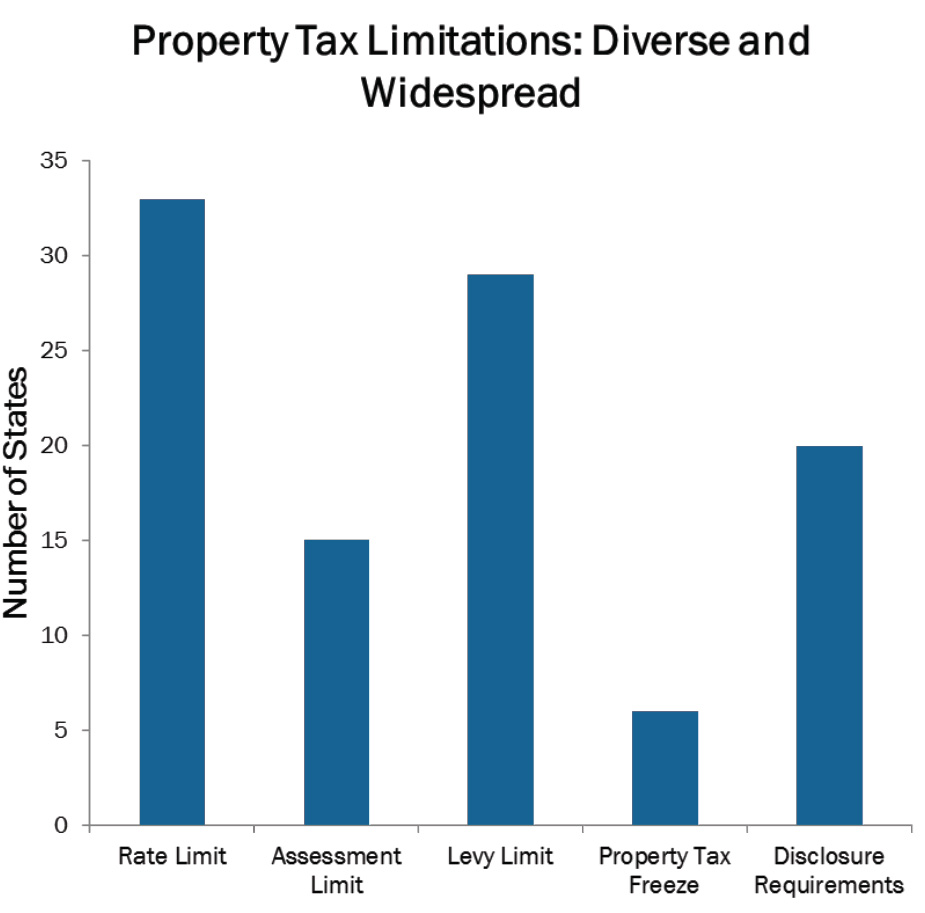

- Forty-two states limit county property tax authority and the number of restrictions has expanded extensively since 1990s.

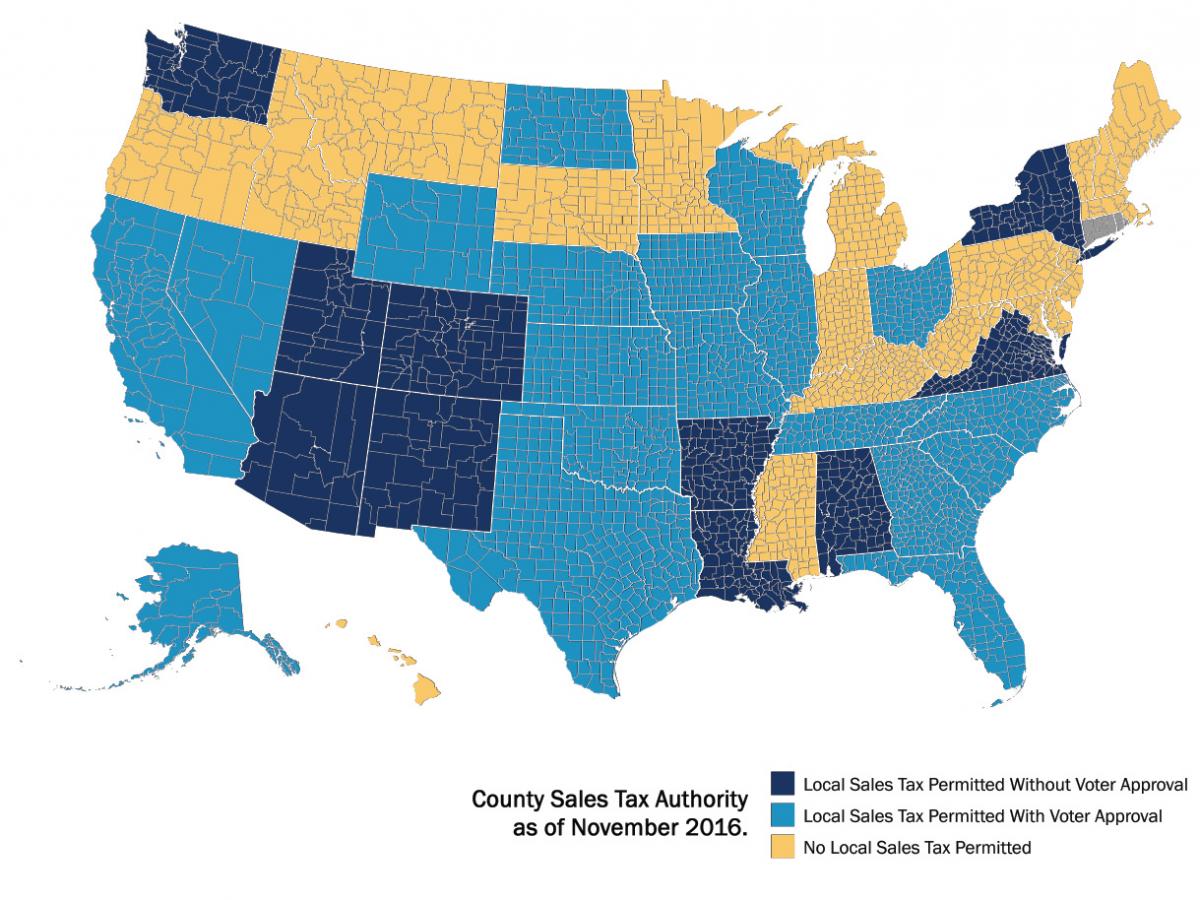

- Only 29 states authorize counties to collect sales taxes, but with restrictions. Twenty-six impose a sales tax limit and 19 ask for voter approval.

- Counties are struggling with more state and federal mandates, not fully covered by state and federal aid. Many county services are mandated by the states or the federal government — from activities in criminal justice and public safety, health and human services, transportation and infrastructure, to administration of elections and property assessments.

Both the state and federal governments must be more cognizant of the financial pressures created by unfunded mandates. The prudence of a mandate cannot be inferred solely by the constitutionality of that mandate. Resolution of these fiscal issues requires enhanced county autonomy regarding revenue generation.

In addition, both state and federal governments must more fully compensate county governments for the mandates imposed. The continued partnership with the state and federal governments is essential to counties’ ability to effectively and successfully support thriving communities across the country.

Attachments

Related News

Counties and Railroads: Shared Priorities for the Next Surface Transportation Bill

County leaders from across the country have a vital opportunity to ensure their infrastructure priorities are front and center.

House reintroduces bipartisan legislation to level playing field for rural communities

House reintroduced the Rural Partnership and Prosperity Act, bipartisan legislation intended to advance economic development in rural counties and overcome barriers to obtaining federal funding and resources.

County Countdown – Dec. 15, 2025

Every other week, NACo's County Countdown reviews top federal policy advocacy items with an eye towards counties and the intergovernmental partnership.